Despite their popularity today, 401(k) plans were created almost by accident and were never intended to replace pension plans. 401(k) plans started when Congress passed the Revenue Act of 1978, which included a provision added to the Internal Revenue Code – Section 401(k), allowing employees to avoid being taxed on deferred compensation. The law went into effect on January 1, 1980, and regulations were issued in November of 1981, which sanctioned the use of employee salary reduction as a source of retirement plan contributions.

1996 was a rather landmark year, where assets in 401(k) plans exceeded $1 trillion, with more than 30 million active participants.¹ Fast forward to 2021, Americans held $10.4 trillion in all employer-based DC retirement plans on September 30, 2021, of which $7.3 trillion was held in 401(k) plans.²

The good news is people continue to save in their 401(k) for retirement. The not-so-good news is that many are not prepared for unexpected emergencies, as we’ve seen during the pandemic. Most experts recommend keeping three to six months’ worth of living expenses in an emergency fund. Still, according to a recent PWC Employee Financial Wellness Survey, more than one-third of full-time employed Millennials, Gen Xers, and Baby Boomers have less than $1,000 saved to deal with unexpected expenses.³

Financial wellness is about more than just workers’ wallets – stress over money and security directly impacts workers’ emotional and physical well-being. That said, many organizations are taking steps to support their employees. Safe to say, financial wellness will continue to be a topic of interest in the retirement and wealth management space as we look to provide workers with a more holistic approach to financial well-being.

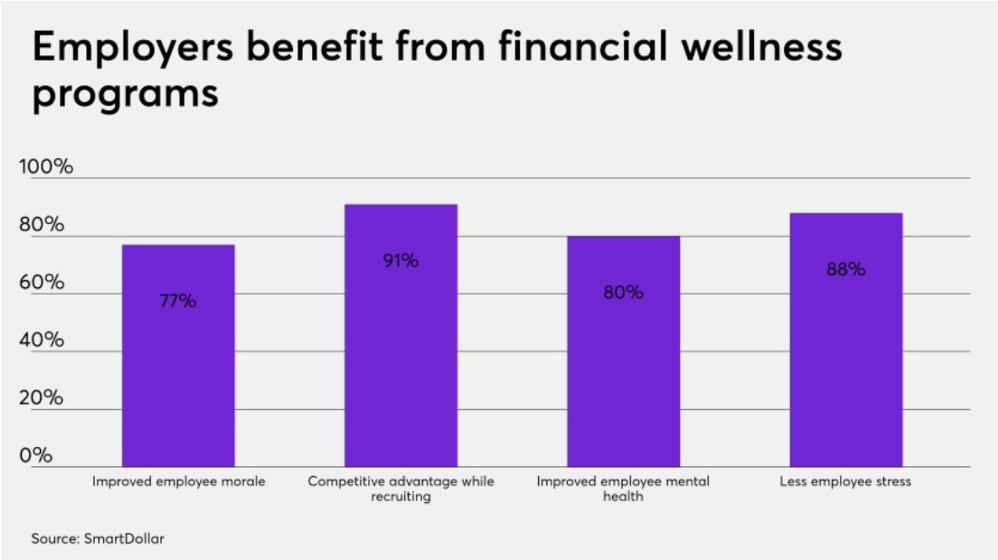

Among the financial challenges of the pandemic and the ongoing fight for talent in today’s market, employees are demanding more from employers than ever before. Almost 80% said it was important that their employer offers financial wellness benefits, and over 70% say these benefits are now more critical than pre-pandemic. Incredibly, 68% prioritize having better financial wellness benefits above an extra week of vacation.5

Some Rather Daunting Facts

58% of consumers either borrowed or withdrew funds from a 401(k) or individual retirement account (IRA) during the pandemic, according to research from Kiplinger’s Personal Finance magazine and wealth management company Personal Capital.4 Per the 2021 Betterment report, The Impact of the Great Resignation5:

- 43% of respondents had to utilize their emergency funds since the pandemic. Nearly twice as many people dipped into these savings for medical expenses, home and auto repairs, and living expenses while temporarily unemployed.

- 54% of workers were somewhat or significantly more stressed about their finances than before the pandemic.

- 58% of Gen Z, 62% of Millennials, and 52% of Gen X respondents indicated their financial stress levels were higher than pre-pandemic, compared to just 35% of Baby Boomers.

- 46% agreed with the statement, “I didn’t think I needed an emergency fund before the pandemic, but now I do.”

Pandemic Heightens Interest in Emergency Savings Vehicles

Many employees are not saving for, or are not prepared to handle a financial emergency. The issue has come to light, especially during the pandemic, as employees across the U.S. were furloughed, had their wages reduced, or hours cut in the wake of the shutdowns and economic crisis brought about by COVID-19. The Coronavirus Aid, Relief, and Economic Security (CARES) Act made it easier for employees to withdraw money from their retirement plans.

Some advocates say that emergency savings accounts, emergency fund accounts, rainy-day accounts, or even sidecar savings accounts can help reduce withdrawals from retirement accounts (leakage) when emergency expenses arise. Employers are more closely looking at practical ways to help employees put away money they can later access in an emergency. Per Willis Towers Watson’s survey of 464 employers, 26% offer an emergency account in their retirement plan, and 19% said they are likely to add one. 6 UPS launched its Emergency Savings Initiative for 90,000 employees in October 2020.

Several products are available today, including The Saxon Demand Account (SDA), an FDIC-insured deposit service that offers a significantly higher interest rate (3x greater on average) while remaining completely liquid, up to 100% FIDC insurance coverage, and highly customizable. Can emergency Savings Accounts help workers avoid accessing their retirement funds early to ensure that their retirement dollars are available when they plan to retire? It is worth investigating as employers look to enhance their financial wellness programs post the pandemic.

Financial Literacy vs. Financial Wellness

I have always contended that part of our job as retirement professionals is to provide workers with the tools, resources, and knowledge to enhance their overall financial well-being. There are significant differences between being financially literate and achieving financial well-being. Simply put, financial wellness can be thought of as a state. It’s the state of having financial security and freedom, while financial literacy is the knowledge of the financial concepts and skills that led you there. Financial literacy is necessary to achieve financial wellness.

As an industry, it is time for us to pivot from retirement readiness to a more holistic or financial wellness focus. This means providing resources and guidance around budget planning, paying off debt, emergency savings, college funding, paying for unforeseen medical expenses, buying a home, and building a nest egg for retirement.

Key Components of a Financial Wellness Program

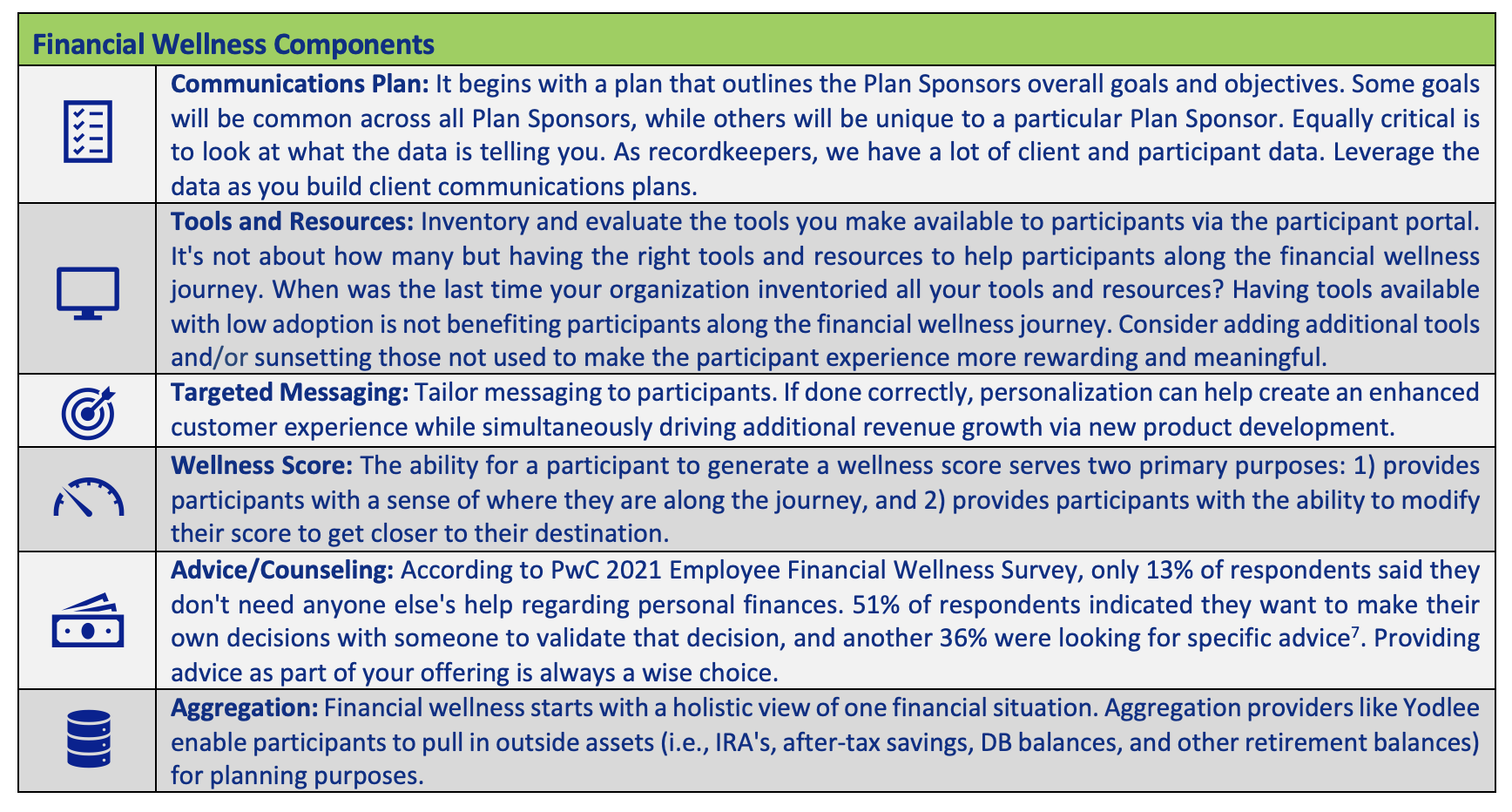

Many providers are looking to enhance or re-evaluate their financial wellness offerings. The table shows six key components of a well-designed financial wellness program.

Summary

In close, the pandemic has brought several things to light… health, family, and the importance of being prepared for unexpected circumstances.

Enterprise Iron provides strategy, technology, and operational support to many defined contribution providers as a financial services consultancy. We have worked with organizations to assess their financial wellness program and welcome the opportunity to assist your firm in re-evaluating your offering.

Email the team to learn more: info@enterpriseiron.com

¹History of 401(k) Plans, EBRI.org Fast Facts November 5, 2018, #318.

²Retirement Assets Total $37.4 Trillion in Third Quarter 2021, Quarterly Retirement Market Data, Investment Company Institute, December 16, 2021.

³Kent E. Allison, Arron J Harding, PwC’s 9th Annual Employee Financial Wellness Survey Covid-19 Update, PwC US, 2020.

42020 Retirement Survey Sponsored by Personal Capital, Kiplinger’s Personal Finance.

5The Impact of the Great Resignation, Betterment, September 2021.

6The New Employer Benefit: Matching Emergency Savings, Anne Tergesen, August 27, 2021, The Wall Street Journal.

7PwC’s 10th Annual Employee Financial Wellness Survey, PwC US, 2021.