In the summer of 2020, I had the pleasure of moderating an industry panel discussion, co-hosted by SPARK and Defined Contribution Institutional Investment Association (DCIIA) during the Summer Public Policy Forum Series. The panel included experts from five (5) of the leading retirement providers in the defined contribution space and an ERISA attorney on Lifetime Income Disclosures.

Fast forward 14 months later, we are preparing to implement the amended ERISA disclosure rules, as Lifetime Income Illustration requirements took effect on September 18, 2021 ― one year after the Interim Final Rule publication date.

Background

Section 105 of the Employee Retirement Income Security Act of 1974 (ERISA) requires administrators of defined contribution plans to provide participants with periodic pension benefit statements furnished at least annually, or at least quarterly if the plan allows the participant to direct their own investments in their individual accounts.

The Setting Every Community Up for Retirement Enhancement Act of 2019 (SECURE Act) amended ERISA’s disclosure rules to require that administrators of defined contribution plans provide participants with two additional lifetime income illustrations at least annually or quarterly, as noted above.

Under the SECURE Act, Congress directed the United States Department of Labor (DOL) to do three (3) things:

1. Issue an Interim Final Rule explaining how to calculate the lifetime income illustrations, specifically laying out the assumptions and other factors that plan administrators must use for calculating the estimated lifetime income stream that could be provided given the current account balance.

2. Issue model language that explains the illustrations and assumptions.

3. Issue the Interim Final Rule, assumptions, and model language within 12 months of enactment of the SECURE Act, enacted on December 20, 2019.

The Premise Behind Amending ERISA Disclosure Rules

“Employee Benefits Security Administration (EBSA) believes that illustrating a participant’s account balance as a stream of estimated lifetime payments, in accordance with the Interim Final Rule will help workers in defined contribution plans to better understand how their account balance translates into monthly income in retirement and therefore to better prepare for retirement.”¹

In accordance with The SECURE Act, two (2) additional lifetime income illustrations will need to be included on participant statements:

1. A single life annuity with payments over the participants lifetime

2. A qualified joint and survivor annuity with equal payments over the participant and spouse’s lifetime

The Interim Final Rule and Assumptions used to Calculate Monthly Payment Illustrations

The DOL published the Interim Final Rule for Lifetime Income Illustrations on September 18, 2020. The Interim Final Rule also provides the public an opportunity to comment on the Interim Final Rules methodologies, requirements, and model language before the publication of the final rule.

The agency solicitation on the Interim Final Rule received 36 submissions where commentators requested clarification on the applicability of the rule, the method for furnishing benefit statements, and in some cases commenters requesting transition relief to ensure affected parties had sufficient time to effectively implement the requirements of the Interim Final Rule.

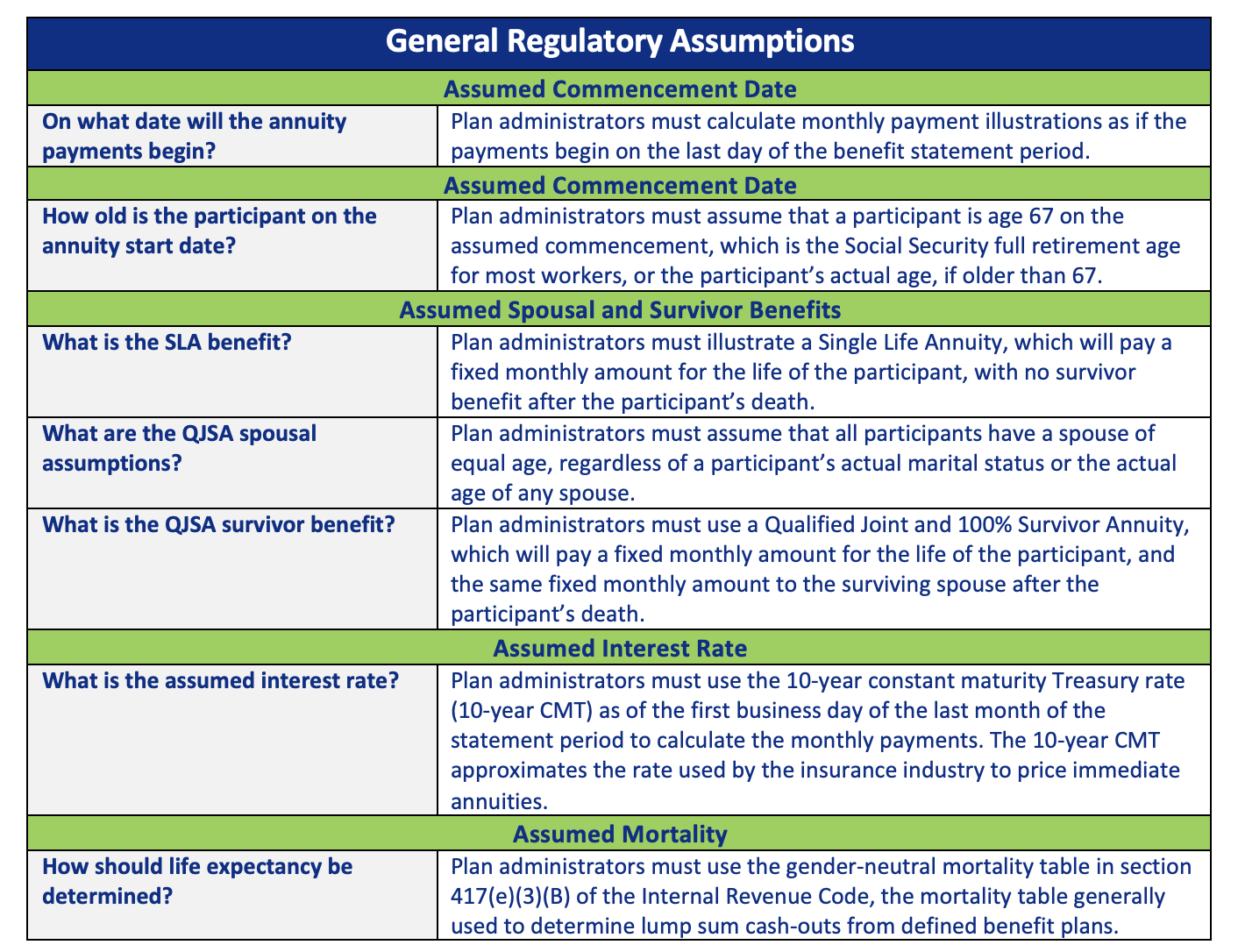

The Fact Sheet, published on August 18, 2020, contains assumptions that plan administrators must use to calculate the monthly payment illustrations of participants’ account balances as Single Life Annuity (SLA) and Qualified Joint and 100% Survivor Annuity (QJSA):

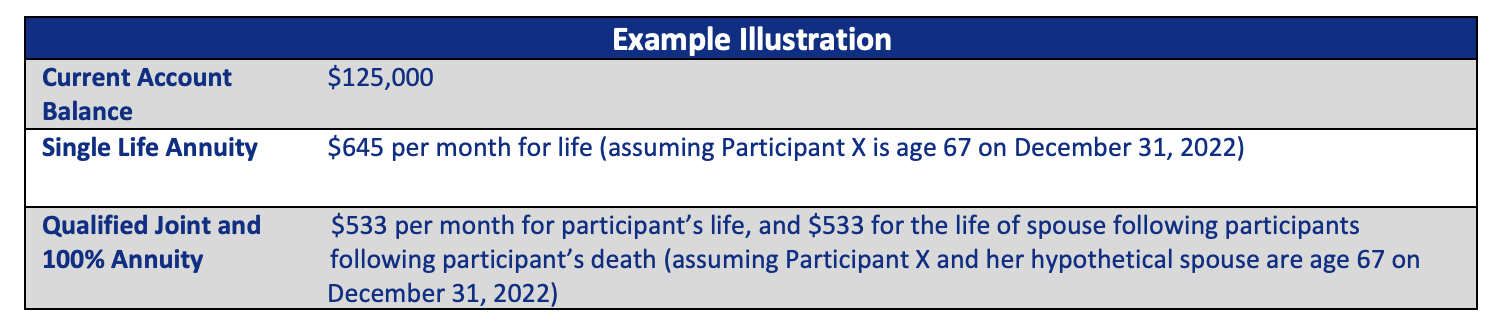

An example based on the following facts is presented below¹:

• Participant X is age 40 and single

• Her account balance on December 31, 2022, is $125,000

• The 10-year CMT rate is 1.83% per annum on the first business day of December

DOL Clears up Timing for Lifetime Income Illustration Disclosures

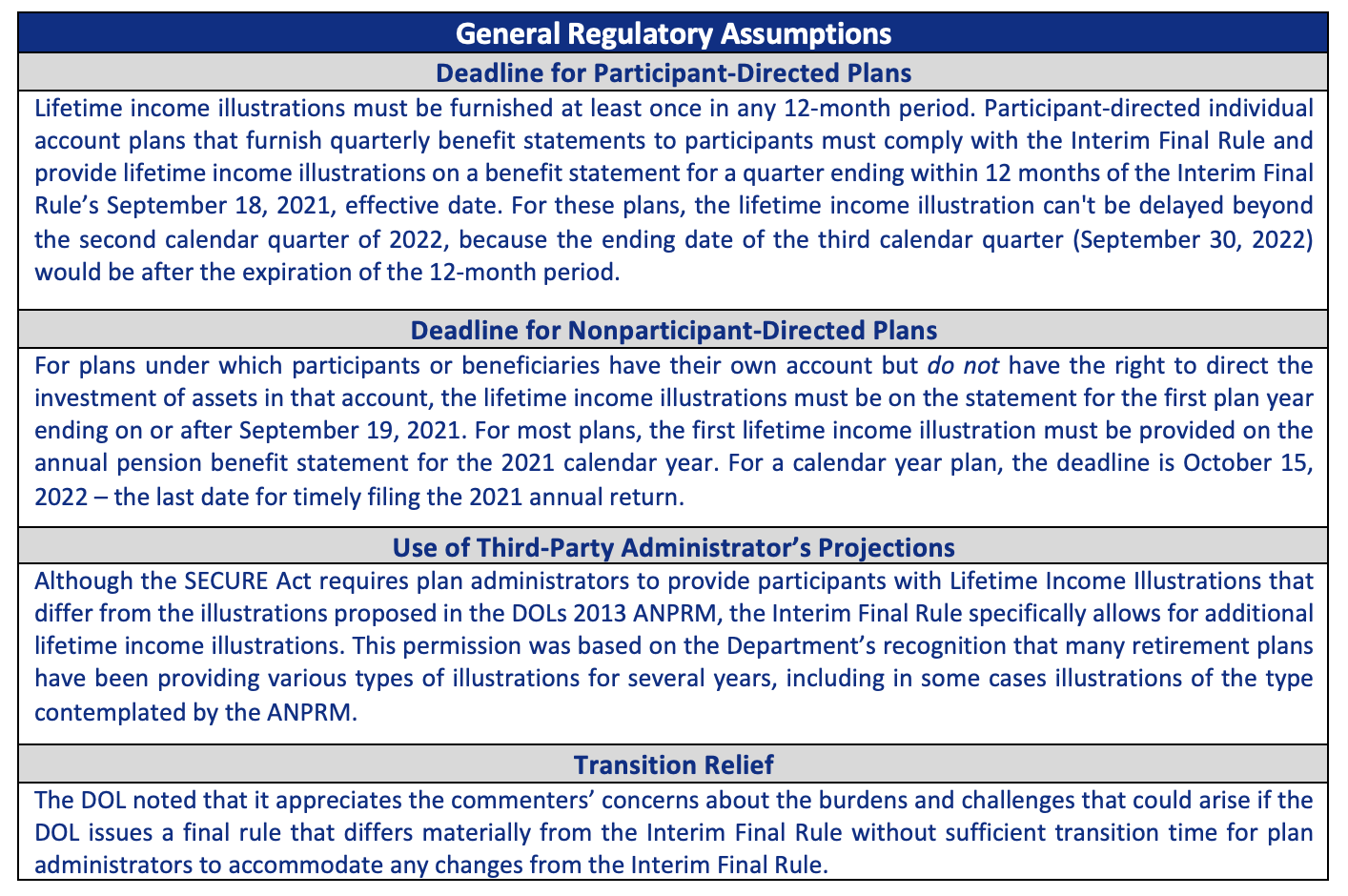

The DOL issued Temporary Implementing FAQs on July 26, 2021, clarifying points not addressed when the DOL issued the Interim Final Rule last September 18. The Interim Final Rule solicited comments on the regulations, and the FAQs address four questions that were raised by commenters:

Summary

Plan sponsors need to be aware of the upcoming deadlines and work with their plan administrators to ensure that processes are in place to furnish the newly required Lifetime Income Illustrations in their pension benefit statements on time. Since the final rule has yet to be published as of the publication of this article, both plan sponsors and plan administrators will need to keep a close watch on when the final rule will be published and modify compliance around, if variations emerge from the Interim Final Rule.

As a leading consultancy in the Financial Services industry, Enterprise Iron is well-known and respected in the retirement space. For almost 20 years, we have been providing strategy, technology, and operational support to many of the defined contribution providers. If Enterprise Iron can be of assistance to your firm in any way, please give us a call at 888.242.4682.

Author: Denise Gumlak

As an agency of the DOL, EBSA is charged with enforcing the rules governing the conduct of plan managers, the investment of plan assets, the reporting and disclosure of plan information, the fiduciary provisions of the law, and workers/benefits rights.

EBSA is responsible for more than 660,000 defined contribution plans that are covered by the ERISA, as well as the approximately 102 million workers who participate in these plans.¹

1https://www.dol.gov/sites/dolgov/files/ebsa/about-ebsa/our-activities/resource-center/fact-sheets/pension-benefit-statements-lifetime-income-illustrations.pdf