Are you prepared for adventure and ready to implement the biggest legislative changes in almost two decades brought on by the SECURE Act 2.0? For those of you also in the retirement industry – we are in this together! As you know, the passing of SECURE Act 2.0 created significant changes to plan provisions, recordkeeping systems, communication materials, and administrative processes.

Published October 17, 2023

Margie Brown, Principal Consultant

To make things more challenging, we are traversing through staggering effective dates, while waiting for guidance, technical corrections, and any possible additional changes to the law. We have received some guidance from the IRS this year including workarounds for technical issues, but it is expected that additional guidance will take years to publish.

The deadline to sign plan amendments under SECURE Act 2.0 for most qualified plans and 403(b) plans is no later than December 31, 2026. For collectively bargained plans the deadline is December 31, 2028, and for governmental and public school 403(b) plans the deadline is December 31, 2029. These amendment deadlines also coordinate with the deadline to sign the amendments under SECURE Act 2019, CARES Act, and Miner’s Act. In the meantime, plan sponsors must operate their plans in accordance with existing laws for mandatory provisions, along with tracking and maintaining operational compliance with any optional voluntary elected provisions from the date they became effective. Provisions under the SECURE Act 2019 and SECURE Act 2.0, along with the CARES Act and Miner’s Act, must be tracked up until the plan document is formally amended for these provisions.

Employers, recordkeepers, payroll providers, consultants, and legal counsel will need to work closely in conjunction to implement and ensure plans are operating in compliance with the SECURE Act changes, and plan sponsors will need to educate and inform plan participants regarding these changes. Certain provisions may require manual workarounds as some service providers may not have an automated platform available or still need to update software programs to accommodate the changes. It is important that service providers have an operational checklist to assist plan sponsors in documenting and tracking elections until the plan amendment is signed.

The best way to move forward is to act now and set up best practices if you have not yet started. Easier said than done, right! Let’s roll up our sleeves and get to work together to be prepared and not have to worry about scrambling at the last minute or missing an important deadline. Enterprise Iron’s Retirement Plan Compliance Services (RPCS) team will take the burden off your shoulders as we develop and implement tailored solutions to meet all your compliance needs!

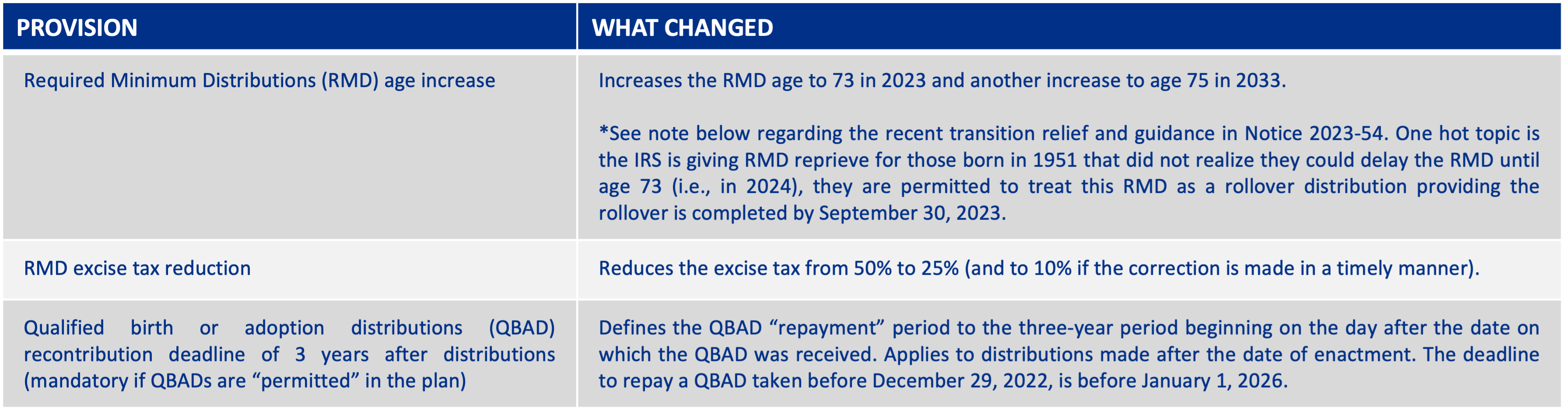

Below are a few high-impact mandatory changes brought on by SECURE 2.0 in 2023:

*Note: The IRS provided transition relief and guidance on the above Required Minimum Distribution by issuing Notice-2023-54 (irs.gov).

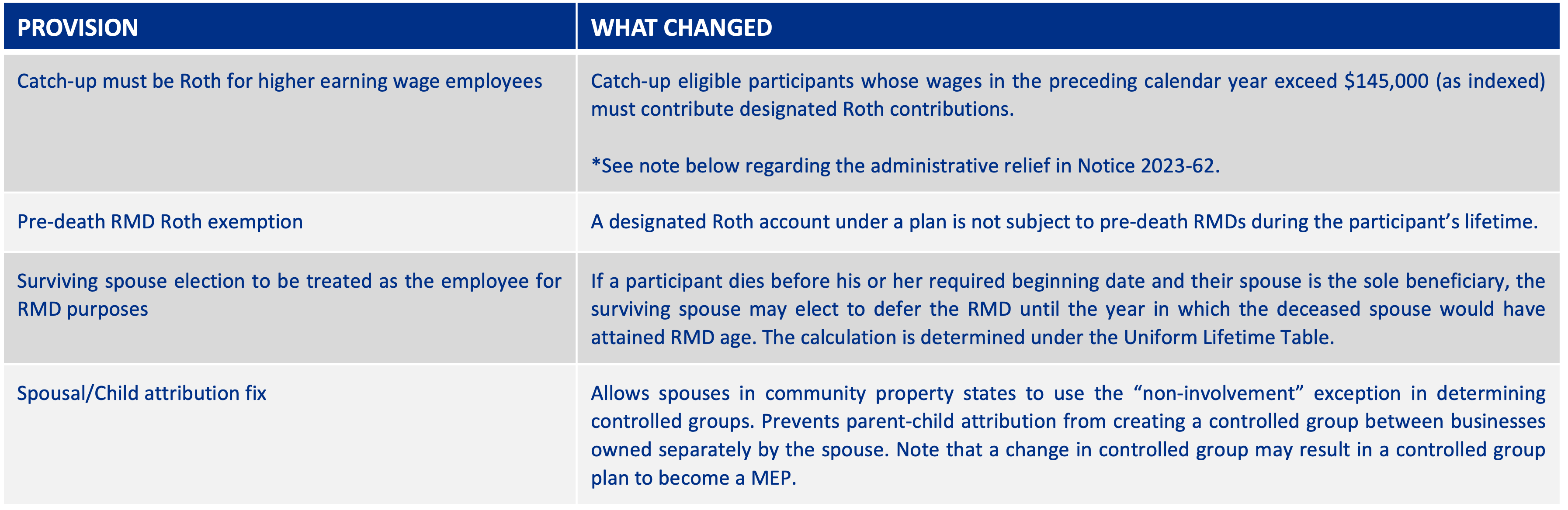

Below you will find a few mandatory changes effective by 2024:

*Note: Catch-up contributions treated as Roth contributions for higher-income participants. The Treasury and IRS received many concerns from the industry regarding the burden to timely implement this provision. There was also confusion regarding how the bill was written due to a technical drafting error removing catch-up contributions entirely in the year 2024.

The IRS provided much-needed relief when releasing Notice 2023-62 announcing a two-year “administration transition period” delaying the effective date of the Roth catch-up requirement. This means that the plan sponsor can begin administering this law on January 1, 2024, if they are ready to do so, but have until January 1, 2026, to implement it if they are not. Read: Guidance on Section 603 with Respect to Catch-Up Contributions (irs.gov)

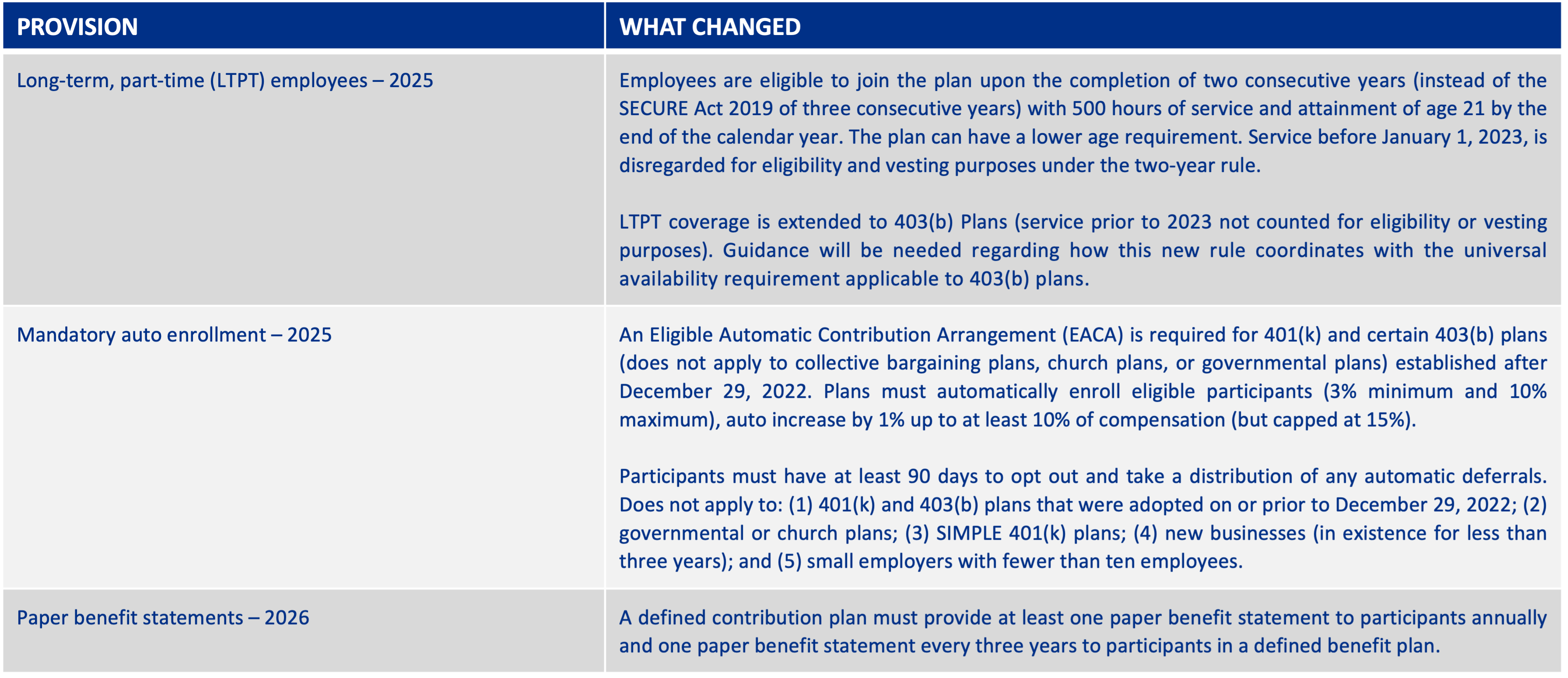

Below you will find a few mandatory changes effective after 2024:

The takeaway is to stay on top of any mandatory changes and effective dates, and to document any optional provisions elected and the effective date of the elected provision. Our Retirement Plan Compliance Services (RPCS) team is highly skilled and can assist you with:

- Tailored solutions to suit your needs

- C² Compliance Calculator: We can help with the minimum distribution rules

- Plan Document Services: Regulatory plan amendments, restatements, new plan onboarding, and plan design changes

- Government Form Filling

- Audit & Operation Support

- Compliance Testing

Let Enterprise Iron assist you with navigating this complex compliance landscape! Email compliance@enterpriseiron.com today to get started.